tempe arizona sales tax calculator

Modify Section 16-460a entitled Retail Sales. For states that have a tax rate that is less than Arizonas 56 tax is collected by the state of Arizona at the time of purchase.

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. For example if your budget for your next car is 15000 and you make your purchase in Apache County you would pay about 915 in sales tax 15000 x 061. However you may need either a Transaction Privilege Tax License aka TPT or sales tax license and a Tempe Regulatory License.

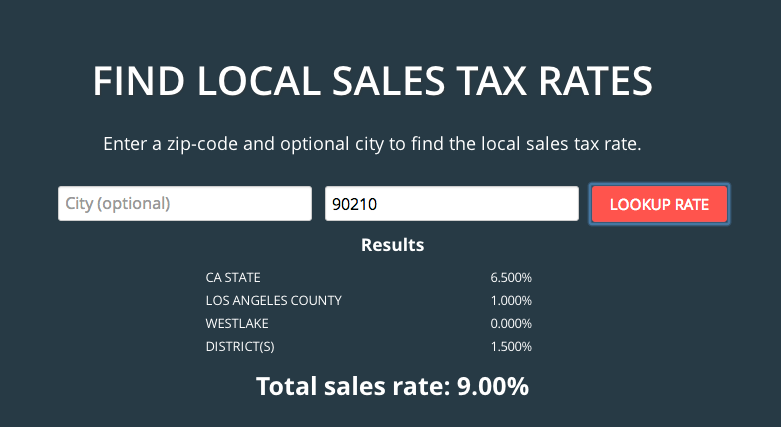

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. What city in Arizona has the highest tax. The December 2020 total local sales tax rate was also 8100.

City Hall 31 E. The Tempe Arizona sales tax is 810. What is the sales tax rate in Tempe Arizona.

Apply or Renew on the Accela Citizen AccessACA Portal. Youll then get results that can help provide you a better idea of what to expect. The base state sales tax rate in Arizona is 56.

The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Ad Lookup Sales Tax Rates For Free. RE trans fee on.

S Arizona State Sales Tax Rate 56 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the Tempe Sales Tax Calculator or compare Sales Tax between different locations within Arizona using the Arizona State Sales Tax Comparison Calculator. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Arizona local counties cities and special taxation districts.

2022 Cost of Living Calculator for Taxes. There are a total of 101 local tax jurisdictions across the state collecting an average local tax of 2146. Download all Arizona sales tax rates by zip code The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Tempe local sales taxesThe local sales tax consists of a 070 county sales tax and a 180 city sales tax.

Sales Tax State Local Sales Tax on Food. Tempe AZ Sales Tax Rate Tempe AZ Sales Tax Rate The current total local sales tax rate in Tempe AZ is 8100. The December 2020 total local sales tax rate was also 6300.

The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223. The Tempe Sales Tax is collected by the merchant on all qualifying sales made within Tempe. Sales Tax Breakdown Tempe Junction Details Tempe Junction AZ is in Maricopa County.

Interactive Tax Map Unlimited Use. The minimum combined 2022 sales tax rate for Tempe Arizona is 81. Real property tax on median home.

Tempe Arizona and Tucson Arizona. The County sales tax rate is 07. The Arizona sales tax rate is currently 56.

The combined rate used in this calculator 81 is the result of the Arizona state rate 56 the 85281s county rate 07 the Tempe tax rate 18. Arizona are 03 cheaper than Tempe Arizona. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

Tempe Junction AZ Sales Tax Rate The current total local sales tax rate in Tempe Junction AZ is 6300. Method to calculate Tempe Junction sales tax in 2021. If this rate has been updated locally please contact us and we will update the sales tax rate for Tempe Arizona.

Impose an additional 200 bed tax. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. This will give you the sales tax you should expect to pay.

Once you have a budget in mind multiply that number times the decimal conversion of the sales tax percentage in your municipality. You can print a. Tempe AZ 85280 salestaxtempegov.

Did South Dakota v. There is no applicable special tax. The Tempe sales tax rate is 18.

The rate will 180. Sales Tax Breakdown Tempe Details Tempe AZ is in Maricopa County. The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223.

Higher sales tax than 58 of Arizona localities 28 lower than the maximum sales tax in AZ The 81 sales tax rate in Tempe consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 18 Tempe tax. The average sales tax rate in Arizona is 7695. Wayfair Inc affect Arizona.

85 Average Sales Tax Summary. Cost of Living Indexes. Find your Arizona combined state and local tax rate.

This is the total of state county and city sales tax rates. Tempe is in the following zip codes. Sales Tax Calculator Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind of sales tax youll see in Phoenix Arizona.

Arizona sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Increased to 300 effective January 1 2003. Arizona Sales Tax Calculator You can use our Arizona Sales Tax Calculator to look up sales tax rates in Arizona by address zip code.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Sales tax in Tempe Arizona is currently 81. Object Moved This document may be found here.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tempe AZ. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Local tax rates in Arizona range from 0 to 56 making the sales tax range in Arizona 56 to 112.

Sales of food for home consumption will be taxed a different rate effective July 01 2010. 85280 85281 85282. Method to calculate Tempe Cascade sales tax in 2021.

The average sales tax rate in Arizona is 7695.

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona

Do This To Save 16 On Every Marijuana Purchase In Arizona

Sales And Use Taxes Chandler Lbs Tax

Arizona Sales Tax Small Business Guide Truic

Tax Tips Ahead Of Monday S Deadline

2021 Arizona Car Sales Tax Calculator Valley Chevy

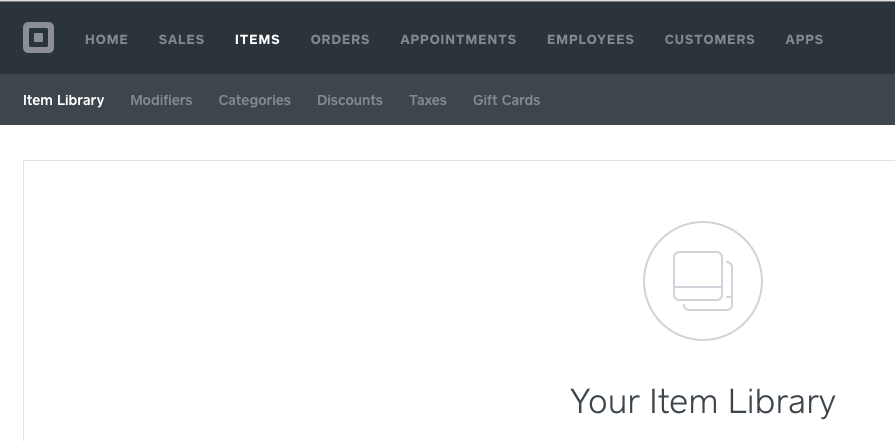

How To Collect Sales Tax Through Square Taxjar

Arizona Income Tax Calculator Smartasset

6 Sales Tax Calculator Template Tax Printables Sales Tax Tax

How To Collect Sales Tax Through Square Taxjar

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

85283 Sales Tax Rate Az Sales Taxes By Zip

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

Property Taxes For In Arizona Everything You Need To Know Kake

Rate And Code Updates Arizona Department Of Revenue

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Arizona Gasoline And Fuel Taxes For 2022

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona