oklahoma franchise tax phone number

Box 26930 Oklahoma City OK 73126-0930. 540 540 2ez 540nr schedule x.

Ment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D.

. While 405-521-3160 is Oklahoma Tax Commissions best toll-free number it is also the only way to get in touch with them. Oklahoma City OK 73126-0850. Local Phone Sales Tax Department.

Oklahoma secretary of state 2300 n. Please put your FEIN on your check. Department of the Treasury.

For additional assistance please contact the agency at 405-521-3160. Press 0 to speak to a representative. 1 Toll Free Phone Sales Tax Department.

With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives. And you ARE ENCLOSING A PAYMENT then use this address. In Oklahoma the maximum amount of franchise tax a.

The franchise tax applies solely to corporations with capital of 201000 or more. If you are a new business register online with the Oklahoma Employer Security Commission to retrieve your Account. We would like to show you a description here but the site wont allow us.

Oklahoma Tax Commission with each report submitted. The franchise tax applies solely to corporations with capital of 201000 or more. In oklahoma the maximum amount of franchise tax a corporation can pay is 20000.

Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Oklahoma Form Franchise Tax 2020-2022. Youll find a wealth of information on our web- site including downloadable taxformsanswersto common questions and online filing options forboth income and business taxes.

The in-state toll free number is 800 522-8165. Our mailing addresses are grouped by topic. Estimated Return EOklahoma F.

Eligible entities are required to annually remit the franchise tax. Oklahoma franchise tax short period. 911 Emergency ServiceEqualization Surcharge.

Oklahoma Tax Commission Franchise Tax Post Office Box 26920 Oklahoma City OK 73126-0920 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers Identi-. File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S. Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma City OK 73126-0930 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers Identification numbers is required on forms filed with the Oklahoma Tax.

Revised 9-2021 Oklahoma Annual Franchise Tax Return FRX200-Office Use Only-State of Incorporation G. Retailer Inventory Tracking System RITS 512-463-0959. Visit Us on the Web.

Home Address street and number Daytime Phone area code and number City State or Province Country Postal Code Title 2. Sales Tax Permit. General Oklahoma Tax Commission Address.

These elections must be made by. State Services Local Services About PayOnline. Eligible entities are required to annually remit the franchise tax.

If you are the Master logon and have cancelled your own online access you will need to contact. Oklahoma franchise tax return due date extension. Individual Income Tax Balance Due.

Who to Contact for Assistance For franchise tax assistance call the Oklahoma Tax Commission at 405 521-3160. Electronic Reporting and Webfile Technical Support. Kansas City MO 64999-0002.

If you already have a Withholding Tax Account ID you can find this number on correspondence from the Oklahoma Tax Commission. Oklahoma Tax Commission PO Box 26850 Oklahoma City OK 73126-0850 This form is used to notify the Oklahoma Tax Commission that the below named corporation is electing to. Oklahoma Employer Account Number and Tax Rate.

Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types Income Tax Corporate Sales Use Withholding Alcohol Tobacco Miscellaneous Business Sales Tax Business Use Tax Business Motor Fuel. Oklahoma Tax Commission Payment Center. Electronic Reporting and Webfile Technical Support.

Oklahoma Tax Commission PO Box 26850 Oklahoma City OK 73126-0850 Local Phone Sales Tax Department. Eligible entities are required to annually remit the franchise tax. Oklahoma franchise tax phone number.

The franchise tax is calculated at a rate of 125 per 1000 of capital employed in or apportioned to the businesss outpost in Oklahoma. First Name Middle Initial Last Name Social Security Number. Create this form in 5 minutes.

Mandatory inclusion of Social Security andor Federal Employers Identification numbers is required on forms filed with the Oklahoma Tax.

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

Otc Form Ef V Download Fillable Pdf Or Fill Online Business Filers Income Tax Payment Voucher For Form 512 512 S 513 513 Nr Or 514 Oklahoma Templateroller

Oklahoma Tax Reform Options Guide Tax Foundation

Franchise Tax What Is It Fundsnet

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Tweets With Replies By Oklahoma Tax Commission Oktaxcommission Twitter

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Tweets With Replies By Oklahoma Tax Commission Oktaxcommission Twitter

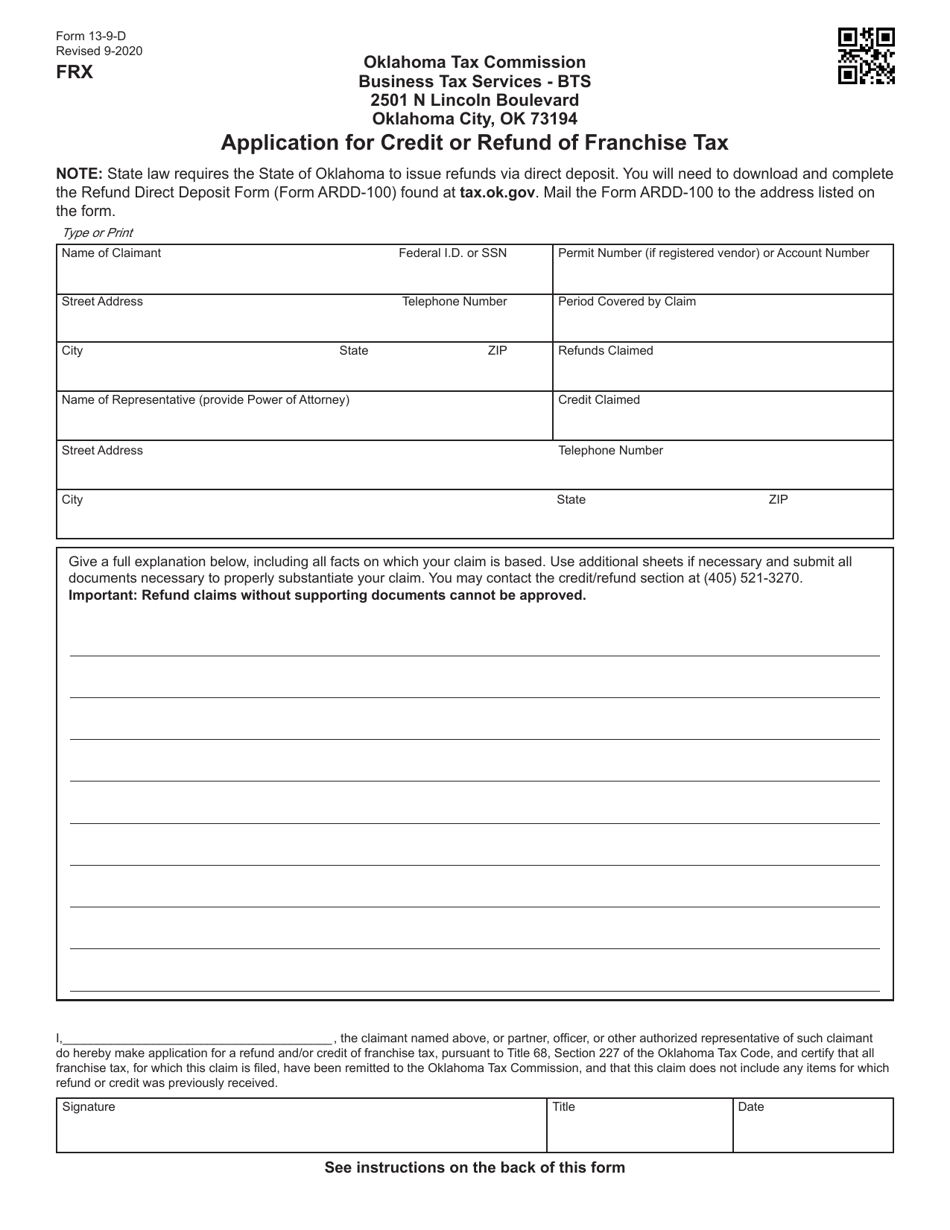

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Tweets With Replies By Oklahoma Tax Commission Oktaxcommission Twitter